Toronto is not known for its affordability. If you’re looking for a condo in Toronto, you’ve probably noticed that rents are already very high. In this article, I’ll tell you the true average living expenses in Toronto, which I’m paying daily as I write this. I’ll also give you a few tips on reducing your daily bills.

Living Expenses in Toronto: Housing Costs

Rent Prices in Downtown Toronto

Let’s start with the biggest expense on my budget: rent. For a 1-bedroom apartment in the downtown core, you’re looking at around C$2400 to C$2800 per month.

To reduce this budget, you have two options:

- Move away from the downtown core by looking in the Eglinton district, or even by expanding your search to nearby cities (such as Mississauga, Scarborough, or Etobicoke).

- Opt for a shared apartment: on average, a shared room will cost you between C$1,200 and $1,700 CAD per month.

Water and hydro

Generally, water is directly included in your rent. However, if in an ad you see that “hydro” is extra, they are referring to electricity. The Canadian system is specific. Even though there are several electricity providers, as a tenant you won’t always have a say in your choice of provider.

In fact, as a general rule, condos have partnerships with an electricity provider that will be imposed on you. When doing your search, this may be a selection criterion or at least a question to ask. In our case, our provider is Provident, and when you look at their invoices in detail, you realize that they charge more than half in “management fees” which are not compressible. So, in practical terms, even if we don’t use any electricity, we’ll still have to pay more or less the same amount.

Coming back to the cost, your electricity bill will vary according to the size of your home and your consumption. However, to give you a rough idea, expect to pay between C$100 and C$150 per month.

Internet

There’s a wide range of Internet packages on offer. They can include your phone, Internet, and TV package. So, depending on your choice, your price can vary widely. Generally speaking, for Internet only, you can expect to pay between C$50 and C$100 per month.

To reduce your bill, don’t hesitate to look directly at the providers’ websites. The main providers are Bell, Rogers, Fizz, and Telus. There are usually attractive offers for new customers. Also, as with electricity, some condos have partnerships with Internet providers who will propose an offer for the condo only. This is personally our case. Don’t hesitate to ask the receptionist.

Home Insurance

Although it’s not mandatory in Canada to subscribe to home insurance, it’s highly recommended. As our elders would say: better safe than sorry!

The price of home insurance can vary depending on your neighborhood, your building, and the coverage you choose. Expect to pay between C$20 and C$40 per month. You can get a better idea by requesting a quote directly from the insurers’ websites. Take a look at Sonnet or Square One, for example.

Monthly Food Expenses in Toronto

Food costs significantly impact the average living expenses in Toronto. Indeed, food is our second biggest expense. Between our arrival in March 2022 and today (May 2024), we’ve experienced an increase in food prices (hello inflation). Some products are very expensive, such as meat, alcohol, and even fruit. In France, for example, we were devotees of Potager City, where we received a box of local fruit and vegetables for €20. The Canadian equivalent is Mama Earth, which costs C$45 (31€).

In our case, we get most of our groceries delivered by Walmart, buy our meat from Farm Boy, our fruit and vegetables from Mama Earth, and hygiene products from Rexall. In case we need extra groceries, we head to either Loblaws or NoFrills, the discount version of Loblaws. Granted, that’s a lot of stores!

If you live near Saint Lawrence Market, I can’t recommend shopping there for fresh products enough. Products are fresh, good, and for a very reasonable price!

Our grocery budget, for two people, comes to around C$600 a month.

Transportation Expenses in Toronto

Public transport costs

The TTC (Toronto Transit Commission) offers a C$156 monthly pass for public transport (subway, bus, and streetcar). With a single ticket costing C$3.35, the monthly pass pays for itself if you take the subway at least twice a day for 23 days in the month.

If you only take public transport occasionally, I recommend paying directly at the gate that gives you access to the metro lines. You can pay with your credit card and you’ll be charged the price of a single ticket.

Bicycles

Buying a bike can be a great way to get around Toronto, especially downtown. Check out Facebook Marketplace or Kijiji to find a second-hand bike. Although you’ll be able to use it most of the year, I have to admit that in winter, especially when it’s snowing, it might be a bit more complicated! Nevertheless, it could be a good option to consider.

Car Insurance

If you buy a car, you’ll have to insure it and pay for car insurance. Even if you have several years’ experience in driving in another country, this won’t count in Canada, which will have a major impact on your monthly cost. The price of insurance is also affected by the car model, coverage, and place of residence.

Around me, people with a car pay between C$150 and C$300 per month for their car insurance.

Entertainment and Lifestyle Costs

Sports

Gym memberships cost between C$50 and C$90 per month. Generally, these memberships are paid every two weeks. If you have a gym in your condo, it’s free 🙂

Personally, I’m a big fan of group classes, so I subscribed to Peloton. For as little as C$20 a month, I have access to a library of group classes that I can take online. I also dance at DanceLifeX (C$16 per class).

Dining and nightlife

If at first glance the prices on restaurant and bar menus seem rather reasonable, this changes when it comes to the bill. That’s because menu prices don’t include taxes or tips. You’ll end up paying 13% tax plus a minimum 15% tip.

If I take a dish and a drink in a restaurant, I’m usually looking at a total of C$45-50. If you turn to fast-food restaurants, you can reduce the bill to around C$15 per person.

Finally, at the bar, a pint of beer or a glass of wine costs around C$10, and a cocktail C$18 (taxes and tips included).

Cultural activities

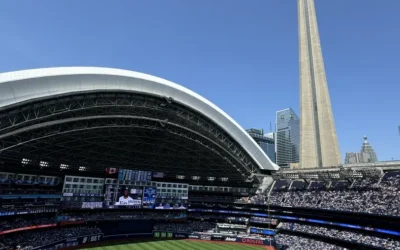

Toronto’s range of activities is truly extensive. Throughout the year, numerous events are organized, including concerts, baseball games (tickets start at C$35), basketball and field hockey games (tickets start at C$100), and shows.

To keep the bill down, free summer festivals are held in town almost every weekend! In winter, grab your ice skates and go skating on the city’s various ice rinks.

Tip: on Tuesdays, the price of a Cineplex movie ticket is cut in half to C$9!

Additional Living Expenses in Toronto

Phone plans

In concrete terms, Canada has not yet experienced the Free revolution. Phone plans are much more expensive than those we have in France. So it’s only natural that you’ll find plans offering 20GB of data at C$40 per month. A quick search reveals that Fizz is starting to offer more affordable packages.

Tip: if you are currently in a country where your plan already covers Canada, keep it! To get a Canadian number, use an application that generates a Canadian number for you, such as TextNow (C$10 per year). In my case, I’ve kept my French plan with Red and use TextNow when I need to give a Canadian number (bank, job search, taxes, etc.).

Banking costs

Most Canadian banks charge a monthly fee for maintaining your account. These fees generally vary between C$10 and C$30. However, as a newcomer, look at offers that banks use to attract you. These offers generally give you 1 or 2 years free banking fees and/or other advantages.

Health benefits

Benefits cover the cost of dentistry, osteopathy, or eyeglasses, for example. If you have an employer, they can offer you this health cover. Generally, this will be highlighted in the job advertisement.

However, if your company doesn’t cover it, I strongly recommend that you take out this insurance. After all, health-related costs rise very quickly in Canada. Expect to pay around C$150 per month.

Total Average Living Expenses in Toronto

To give you a complete picture of average living expenses in Toronto in 2025, here’s my detailed monthly breakdown. Note that common expenses such as rent, groceries, and internet have been divided by 2. For example, in our case, our rent is C$2,600.

| Expenses | Monthly amount per person |

| Rent | C$1,300 |

| Hydro | C$65 |

| Internet | C$30 |

| Home Insurance | C$15.5 |

| Groceries | C$300 |

| Public Transport | C$0 (to get around Toronto, we walk most of the time) |

| Hobbies (sports, bars, restaurants) | C$250 |

| Phone | C$17,6 |

| Total | 1978,1$ CAD |

La Bise,

0 Comments